How to add and edit employee tax information in Namely Payroll.

OVERVIEW

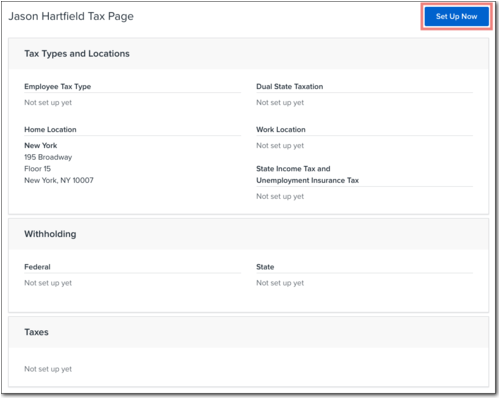

The employee tax page displays the employee’s tax type, dual-state taxation status, home and work locations, where state income and unemployment insurance tax is applied, federal and state withholding information, and specific taxes paid. All fields can be edited except Home Location, which can be edited on the employee’s HCM profile.

Refer to this video: How to add and edit employee tax information in Namely Payroll

If you have not yet added a new employee’s tax information, you can access their tax page by clicking Payroll Tax under Missing Fields on the Profile Status page.

You can also access the employee’s tax page by navigating to Employee > Search in Payroll, using the search function to find the employee’s profile, and clicking Tax.

ADDING TAX INFORMATION FOR A NEW EMPLOYEE

To add a new employee’s tax information, click Set Up Now on their employee tax page.

Tax Type

-

Select a Tax Type. You can select:

-

1099

-

S Corp

-

Standard

-

Click Continue.

Work Location

-

Select an Address.

-

Click Continue.

Note that an office location will not display as a taxable work location unless it has a validated address associated with it.

State Withholding*

-

Enter any state-specific withholding information, including additional withholding, filing status, and allowances.

-

Note: If the live-in and work-in addresses are in different states, you can enter withholding information for both states.

-

Note: If the state allows you to suppress the filing status for the base calculation, it will display the field [State] Suppress Base Calculation. You can:

-

Select Additional if you want to calculate based on the filing status and any additional withholding amounts entered.

-

Select Suppress if you want to ignore the filing status and only calculate based on any additional withholding amounts entered.

-

-

Click Continue.

Federal Withholding*

-

Select a Federal Suppress Base Calculation.

-

Select Additional if you want to calculate based on the filing status and any additional withholding amounts entered.

-

Select Suppress if you want to ignore the filing status and only calculate based on any additional withholding amounts entered.

-

-

Select a Filing Status.

-

Select M for married.

-

Select MH but at a higher single rate.

-

Select S for single.

-

Select whether the employee is in a Two Job Household.

-

Enter the number of Dependents.

-

Enter any Other Income.

-

Enter the dollar amount representing the number of Deductions.

-

Enter any Extra Withholding Amount.

-

Select the Extra Withholding Type.

-

You can select a Dollar amount or a Percentage.

-

-

Click Finish.

* If your organization uses Namely's Tax Withholding Unification feature, any changes to an employee's state or federal withholding information submitted via Manage eSignature or during onboarding will automatically update in Payroll.

Note: In order to calculate the employee’s withholding for both work-in and live-in states, you must opt them in for dual-state withholding. For more information, see Dual State Taxation below.

UPDATING EXISTING EMPLOYEE TAX INFORMATION

You can modify employee’s existing tax information on the employee tax page.

Employee Tax Type

To update an employee’s tax type:

-

Click Modify next to Employee Tax Type.

-

Select a Tax Type. You can select:

-

1099

-

S Corp

-

Standard

3. Click Save.

Dual State Taxation

Dual-state taxation will be calculated if an employee has withholding information entered for live-in and work-in addresses in different states and if they are opted in for dual-state taxation. By default, employees are not opted in to dual-state taxation.

To opt an employee in for dual-state taxation:

-

Click Modify next to Dual State Taxation.

-

Select Yes.

-

Click Save.

If the employee’s Dual State Taxation field is set to No, the state-withholding information for the live-in address will still display, but it will not be used for tax calculations. In order to calculate the employee’s withholding for both work-in and live-in states, Dual State Taxation must be set to Yes.

For more information on dual-state taxation, see Enabling Dual-State Taxation for Existing Employees. For detailed instructions on how to exclude live-in locations for employees whose home state is different from their work-in state, see Excluding Live-In State Tax for Existing Employees.

Work Location

To update an employee’s work address:

-

Click Modify next to Work Location.

-

Select an Address.

-

Click Continue.

-

Enter any state-specific withholding information for the work location.

-

Note: If the state allows you to suppress the filing status for the base calculation, it will display the field [State] Suppress Base Calculation. You can:

-

Select Additional if you want to calculate based on the filing status and any additional withholding amounts entered.

-

Select Suppress if you want to ignore the filing status and only calculate based on any additional withholding amounts entered.

-

-

Click Finish.

State Income Tax and Unemployment Insurance Tax

You can select which location state income tax and unemployment insurance tax apply to:

-

Click Modify next to State Income Tax and Unemployment Insurance Tax.

-

Select Home or Work.

-

Click Save.

Federal Withholding*

To update an employee’s federal withholding information:

-

Click Modify next to Federal under Withholding.

-

Select a Federal Suppress Base Calculation.

-

Select Additional if you want to calculate based on the filing status and any additional withholding amounts entered.

-

Select Suppress if you want to ignore the filing status and only calculate based on any additional withholding amounts entered.

-

-

Select a Filing Status.

-

Select M for married.

-

Select MH but at a higher single rate.

-

Select S for single.

-

Select whether the employee is in a Two Job Household.

-

Enter the number of Dependents.

-

Enter any Other Income.

-

Enter the dollar amount representing the number of Deductions.

-

Enter any Extra Withholding Amount.

-

Select the Extra Withholding Type.

-

You can select a Dollar amount or a Percentage.

-

-

Click Finish.

State Withholding*

To update an employee’s state withholding information:

-

Click Modify next to the state you want to update.

-

Enter any state-specific withholding information, including additional withholding, filing status, and allowances.

-

Note: If the state allows you to suppress the filing status for the base calculation, it will display the field [State] Suppress Base Calculation. You can:

-

Select Additional if you want to calculate based on the filing status and any additional withholding amounts entered.

-

Select Suppress if you want to ignore the filing status and only calculate based on any additional withholding amounts entered.

-

-

Click Save.

* If your organization uses Namely's Tax Withholding Unification feature, any changes to an employee's state or federal withholding information submitted via Manage eSignature or during onboarding will automatically update in Payroll.

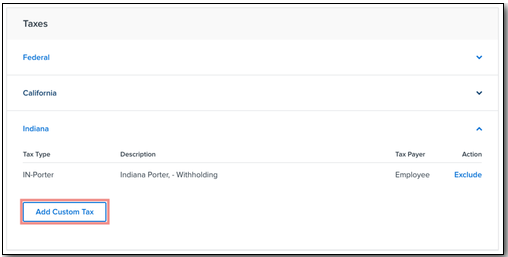

ADDING CUSTOM TAXES

You can apply custom taxes to an employee on their tax page.

To apply a custom tax:

-

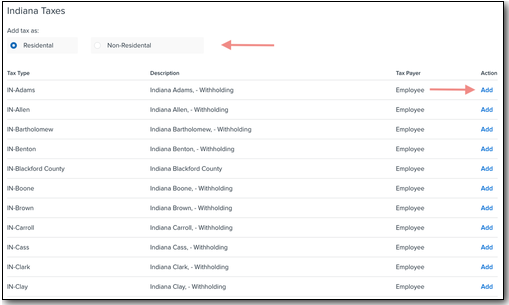

Click Add Custom Tax.

-

Select Residential or Non-Residential.

-

Find the custom tax you want to apply and click Add.

Note: If you add custom taxes for a new jurisdiction, you’ll need to provide Namely with any required tax information. For more information, see Adding a New Tax Code to Payroll

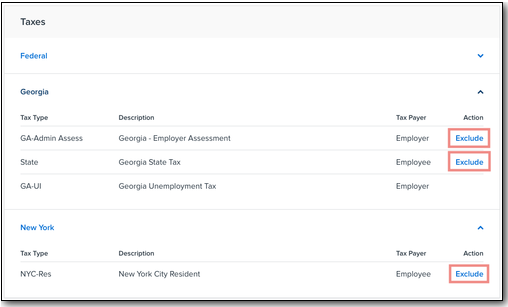

EXCLUDING TAXES

Once you have entered state withholding information for the employee, their federal and state tax information will be listed.

You can choose to exclude specific state tax types by clicking Exclude.

If you have an employee who is exempt from FICA, FUTA, or SUI taxes you can mark their status in Namely Payroll. Use the article Mark Employees Exempt from FICA, FUTA, and SUI Taxes in Payroll for instructions.